How to Trade Gold today’s on News?

Gold inched higher on Wednesday, increasing the price of yellow metal to more than $1200.00 an ounce ahead of the US monetary policy announcement. The technical bias remains bullish because of a higher low in the recent downside move.

US Monetary Policy Announcement

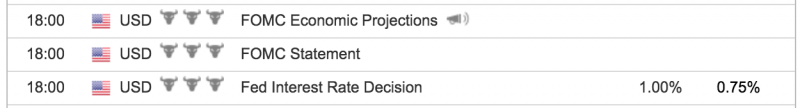

The Federal Reserve is scheduled to announce its monetary policy today during the US trading session (18:00 GMT).

According to the average forecast of different economists, the central bank is likely to increase its benchmark interest rate by 0.25% to 1.00% for the third time since the great recession of 2008.

Generally speaking, higher interest is considered bullish for the US Dollar (USD) and vice versa.

How to Trade today’s News?

- It could be a good strategy to buy put options in gold below the aforementioned support levels if the central bank increases its benchmark interest rate.

- Alternatively, buying the call options above the aforementioned resistance levels can be a good strategy if the Federal Reserve leaves interest rate unchanged.

Technical Analysis

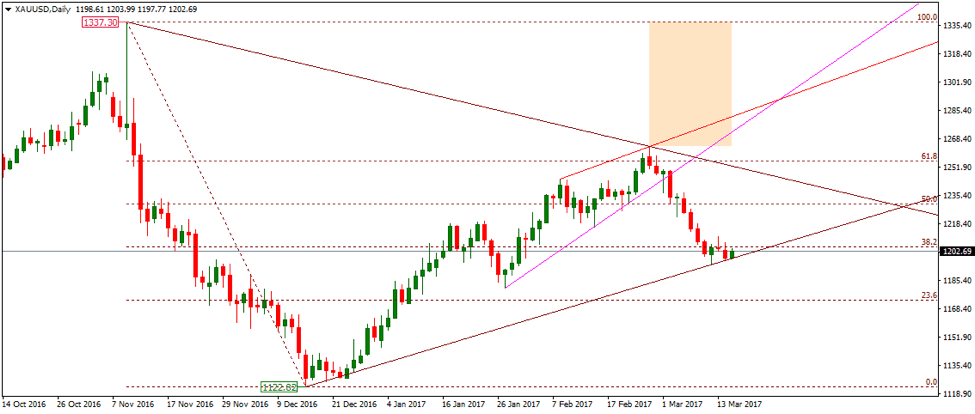

As of this writing, the precious metal is being traded near $1202 an ounce. A hurdle can be noted near $1204, the 50% fib level ahead of $1219, the horizontal resistance area and then $1250, the trendline resistance area as demonstrated with brown color in the given below daily chart.

On the downside, a support may be noted around $1180, the low of January 27th ahead of $1173, the 23.6% fib level and then $1100, the psychological number as demonstrated in the given above daily chart. The technical bias shall remain bullish as long as the $1180 support area is intact.

How Gold Reacted on Past Fed Monetary Policies

Gold didn’t show any noticeable movement after the announcement of last two monetary policies because the central bank kept its benchmark interest rate unchanged at 0.75%.